History of Recessions

Overview

As the world tentatively emerged from the COVID-19 pandemic in early 2021, the U.S. economy benefited from pent-up consumer demand. Americans increased spending as they cautiously ventured from their homes, eventually resulting in annual GDP growth of 5.7% by the end of 2021.1

The fourth quarter of 2021 was especially strong, growing by 6.9% during the holiday shopping season.2 Other signs also indicated that the U.S. economy was well into recovery mode. Unemployment, for example, which had skyrocketed to a record-setting 14.7% in the early days of the pandemic, dropped to 3.9% just 18 months later.3

Given all these positive indicators, it’s understandable that many Americans saw only smooth sailing ahead as we entered 2022. However, more potential challenges were churning just below the surface. Manufacturers and wholesalers, still grappling with supply chain issues, were forced to pass along higher production costs to consumers. Rising labor costs, the Russia-Ukraine war and unprecedented government spending also contributed to rising prices. By March, the Consumer Price Index (CPI) had increased 8.5% year-over-year, the largest 12-month increase since December 1981.4

As a result, many consumers reduced their spending, leading to a GDP decline of 1.4% in the first quarter of 2022.5 Is the contraction a sign that the U.S. is headed for a potential recession soon? What does history tell us about recessions — and what steps should investors take to prepare for a possible pullback in the coming months?

A Brief History of Recessions

The economy is generally considered to be in a recession when we experience two or more consecutive quarters of negative GDP growth. However, analysts also use other factors to measure whether a recession has occurred, including rising unemployment, declining sales and production, and a drop in real income.6

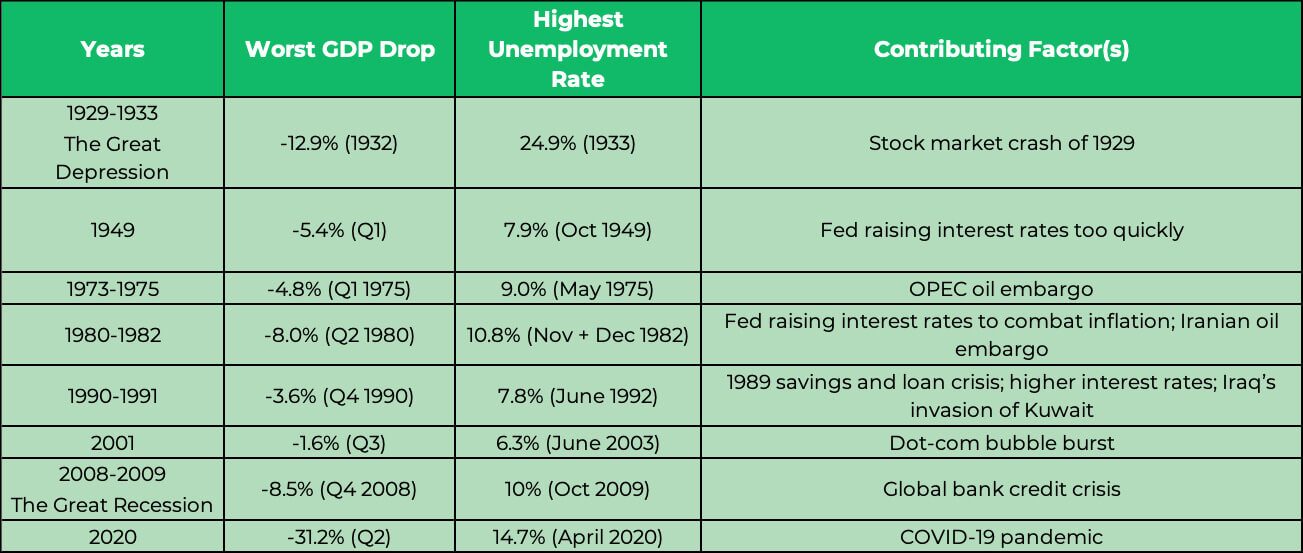

The U.S. has experienced a total of 19 recessions, with 14 of them occurring in the past 100 years.7 The most notable recessions include:

While they generally vary in length and severity, since World War II, recessions have lasted 11.1 months on average.8 The tricky part is identifying a recession while it’s happening; by the time most recessions are recognized as such, they’re almost over. For instance, the Great Recession of 2008-2009 wasn’t officially announced until December 2008, almost a full year after it started. And in 2020, we were already done with the shortest recession on record by the time it was declared as such.9

Still, there are signs to look for that a potential recession could be looming. One sign is an inverted yield curve, when short-term government securities yields are higher than the 10-year Treasury bond. Although not every inverted yield curve has been followed by a recession, every recession has been preceded by an inverted yield curve. In March 2022, the yield curve inverted when the two-year Treasury exceeded the 10-year rate.10

Rising interest rates can also be a catalyst for recession. The Federal Reserve has pushed the U.S. into recession in the past by raising rates too aggressively. The Fed began hiking interest rates in April and is expected to increase rates by 50 basis points (.50%) at both its May and June meetings in an effort to combat inflation.11

Preparing for a Possible Recession

Does the combination of inverted yield curve, rising interest rates and first-quarter GDP contraction indicate a recession is on the horizon? An increasing number of analysts believe so, particularly as the Fed prepares to raise interest rates again.12

If we are headed toward a recession, what actions should investors take to prepare? Here are a few things you need to know:

- Like the markets, you can’t time a recession. Since we often don’t know we’re in a recession or how long it will last, it’s impossible to pinpoint when we’re at the bottom. Markets often sell off before we know the full impact — and rebound ahead of recovery.

- One strategy may be to set aside short-term assets. The average recession lasts about a year. Your short-term assets can be used to get you through that period and allow you to take advantage of opportunities when the economy begins to recover, without dipping into your intermediate- and long-term investments.

- Another strategy may be to focus on commodities and real assets. As we head into a recession, earnings tend to struggle as most companies focus more on a strong balance sheet and less on growth. Consider investing in companies that produce and sell products people need (such as food and gas) instead of want (like luxury goods and electronics).

Final Thoughts

A recession can impact your financial plan, including possible job loss, reduced income or even a change on when you retire. If you’re concerned about a potential recession and its effect on your retirement, reach out to your financial professional. He or she can help you identify strategies to ride out a recession while staying focused on your long-term goals.

1,2 Bureau of Economic Analysis. March 30, 2022. “Gross Domestic Product (Third Estimate), Corporate Profits, and GDP by Industry, Fourth Quarter and Year 2021.” https://www.bea.gov/news/2022/gross-domestic-product-third-estimate-corporate-profits-and-gdp-industry-fourth-quarter. Accessed April 27, 2022.

3 U.S. Bureau of Labor Statistics. “Civilian unemployment rate.” https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm. Accessed April 27, 2022.

4 U.S. Bureau of Labor Statistics. “Consumer prices up 8.5 percent for year ended March 2022.” https://www.bls.gov/opub/ted/2022/consumer-prices-up-8-5-percent-for-year-ended-march-2022.htm#:~:text=The%20Consumer%20Price%20Index%20increased,month%20advance%20since%20December%201981. Accessed April 27, 2022.

5 Jeff Cox. CNBC. April 28, 2022. “U.S. GDP fell at a 1.4% pace to start the year as pandemic recovery takes a hit.” https://www.cnbc.com/2022/04/28/us-q1-gdp-growth.html. Accessed April 28, 2022.

6 Dan Burrows and John Waggoner. Kiplinger. April 21, 2022. “Recessions: 10 Facts You Must Know.” https://www.kiplinger.com/slideshow/investing/t038-s001-recessions-10-facts-you-must-know/index.html. Accessed April 27, 2022.

7 Kimberly Amadeo. April 13, 2022. The Balance. “History of Recessions in the United States.” https://www.thebalance.com/the-history-of-recessions-in-the-united-states-3306011. Accessed April 27, 2022.

8,9 Dan Burrows and John Waggoner. Kiplinger. April 21, 2022. “Recessions: 10 Facts You Must Know.” https://www.kiplinger.com/slideshow/investing/t038-s001-recessions-10-facts-you-must-know/index.html. Accessed April 27, 2022.

10 Patti Domm. CNBC. March 31, 2022. “2-year Treasury yield tops 10-year rate, a ‘yield curve’ inversion that could signal a recession.” https://www.cnbc.com/2022/03/31/2-year-treasury-yield-tops-10-year-rate-a-yield-curve-inversion-that-could-signal-a-recession.html. Accessed April 27, 2022.

11 Indradip Ghosh and Prerana Bhat. Reuters. April 11, 2022. “Fed to raise rates aggressively in coming months, say economists: Reuters poll.” https://www.reuters.com/business/fed-raise-rates-aggressively-coming-months-say-economists-2022-04-11/. Accessed April 27, 2022.

12 Scott Horsley. NPR. April 13, 2022. “Why there are growing fears the U.S. is headed to a recession.” https://www.npr.org/2022/04/13/1092291748/economy-recession-inflation-federal-reserve-interest-rates#:~:text=A%20growing%20number%20of%20forecasters%20now%20believe%20a%20recession%20is,is%20strong%20by%20many%20measures. Accessed April 28, 2022.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report are affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. AE Wealth Management, LLC (“AEWM”) is an SEC Registered Investment Adviser (RIA) located in Topeka, Kansas. Registration does not denote any level of skill or qualification. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. AEWM works with a variety of independent advisors. Some of the advisors are Investment Adviser Representatives (IARs) who provide investment advisory services through AEWM. Some of the advisors are Registered Investment Advisers providing investment advisory services that incorporate some of the products available through AEWM. Information regarding the RIA offering the investment advisory services can be found at http://brokercheck.finra.org.

4/22-2176604

Ready to Take The Next Step?

For more information about any of our products and services, schedule a meeting with an Investment Adviser today or register to attend a seminar.